BCREA: Pent-up Demand Continues to Build as Sales Remain Slow

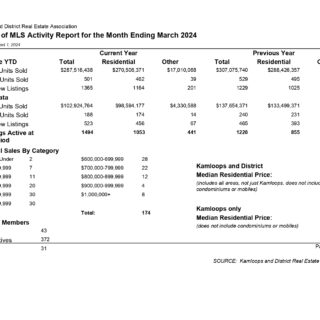

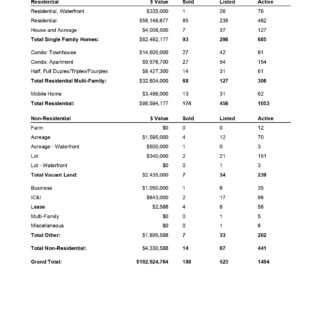

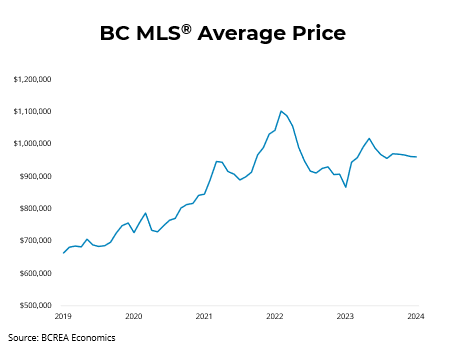

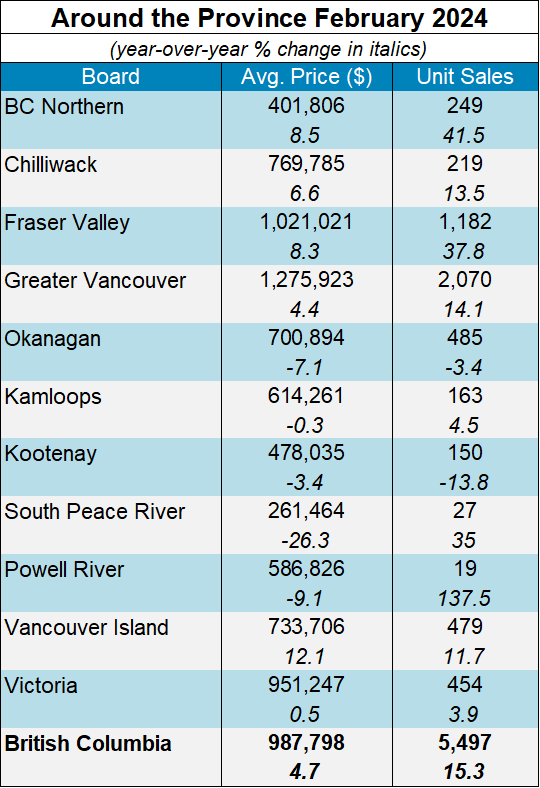

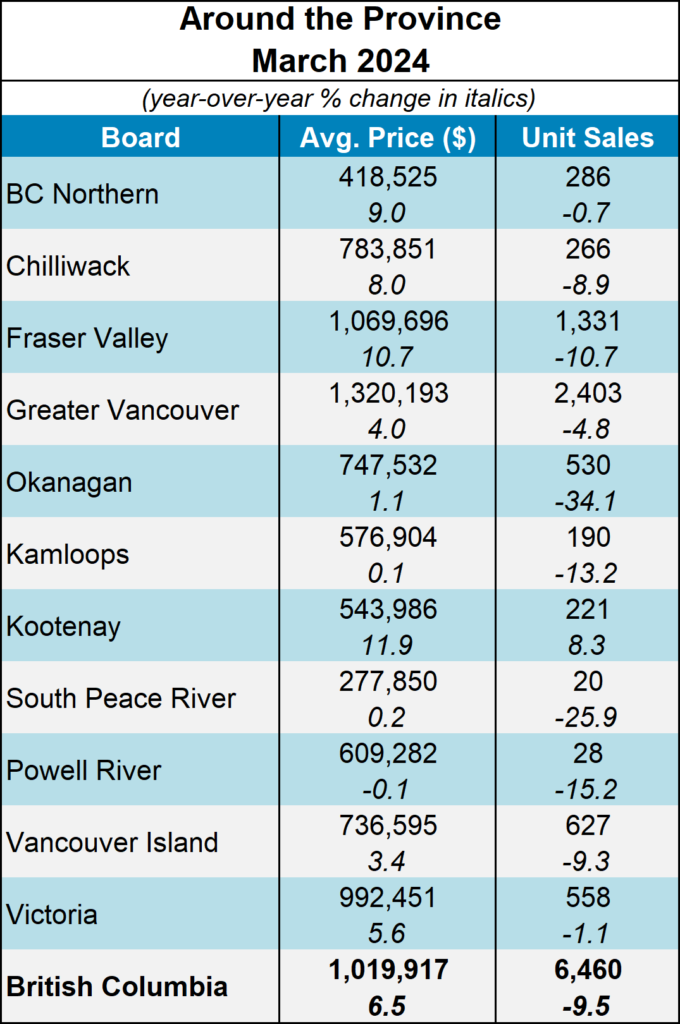

Vancouver, BC – April 15, 2024. The British Columbia Real Estate Association (BCREA) reports that a total of 6,460 residential unit sales were recorded in Multiple Listing Service® (MLS®) systems in March 2024, a decline of 9.5 per cent from March 2023. The average MLS® residential price in BC in March 2024 was up 6.5 per cent at $1.02 million, compared to an average price of $958,051 in March 2023. The total sales dollar volume was $6.6 billion, a decrease of 3.6 per cent from the same time the previous year.

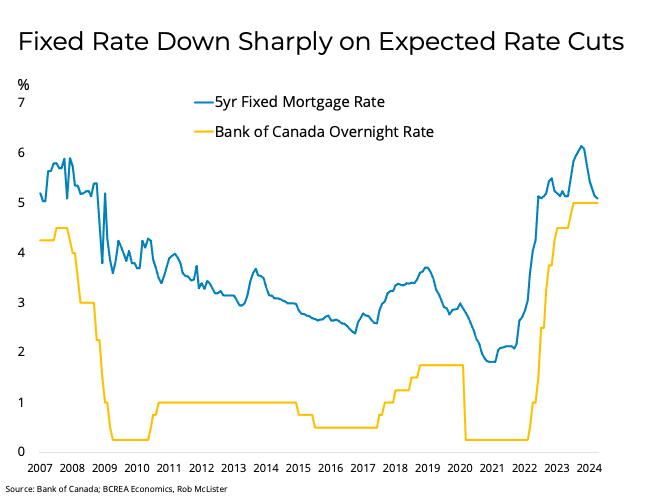

“March capped off a slow start to the first quarter of 2024,” said BCREA Chief Economist, Brendon Ogmundson. “Despite a steep decline in fixed mortgage rates, buyers appear to be waiting on the Bank of Canada to lower its policy rate before jumping back into the market.”

Year-to-date, BC residential sales dollar volume was up 13 per cent to $15.8 billion, compared with the same period in 2023. Residential unit sales were up 6.4 per cent to 15,938 units, while the average MLS® residential price was up 6.5 per cent to $995,149.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information