Canada’s Ban on Foreign Home Buyers Coming in January 2023

On January 1st, 2023 the Canadian Government is implementing a ban on foreign home buyers. Canadian citizens and permanent residents are exempt from the ban while other buyers have different rules based on their situation.

International students and foreign workers are permitted to purchase a property in Canada but they have restrictions they have to satisfy before being able to purchase. They are only permitted to purchase one property. For foreign workers they must have worked in Canada for three of the four years before buying a property. Students are required to be in Canada for 244 days each year for five years before buying and are not permitted to purchase anything over $500,000.

The intention of these restictions to to establish that the international students or foreign workers have an intention to become a permanent resident.

The non-citizens who can purchase a property in Canada without further restricions are: refugees, diplomats, foreign nationals with temporary resident status, consular staff and members of international organizintions living in Canada.

Non-Canadian entities and foreign controlled Canadian entities will be banned from buying property in Canada. This includes a non-Canadian who has a three per cent direct or indirect ownership interest in an entity or corporation.

The ban also doesn’t include properties in less populated areas and often this includes areas where recreational properties exist. The Kamloops area is subject to this legislation however a lot of the outlying areas are not included, such as the Shuswap Lakes region, North Thompson, South Okanagan (including Penticton & Kootenays). Here is a map showing the Census map showing the exempt areas.

These rules are also developed to target residential properties with three or less units. So any properties with four or more living quarters are not part of the exemption for foreign purchases. Properties that are part of the ban are detached homes that contain a private kitchen facility, private bath and private living area and a part of a building that is intended to be owned and used as a place of residence. This includes semi-detached homes, townhouses, condos and row houses.

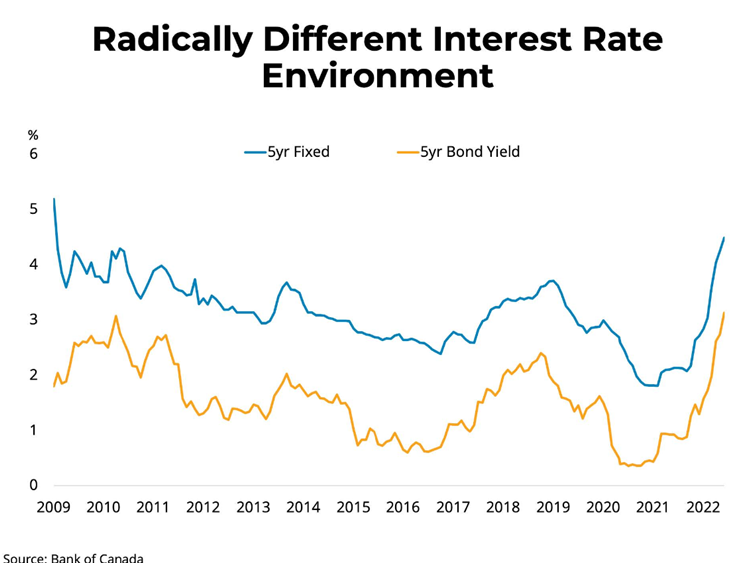

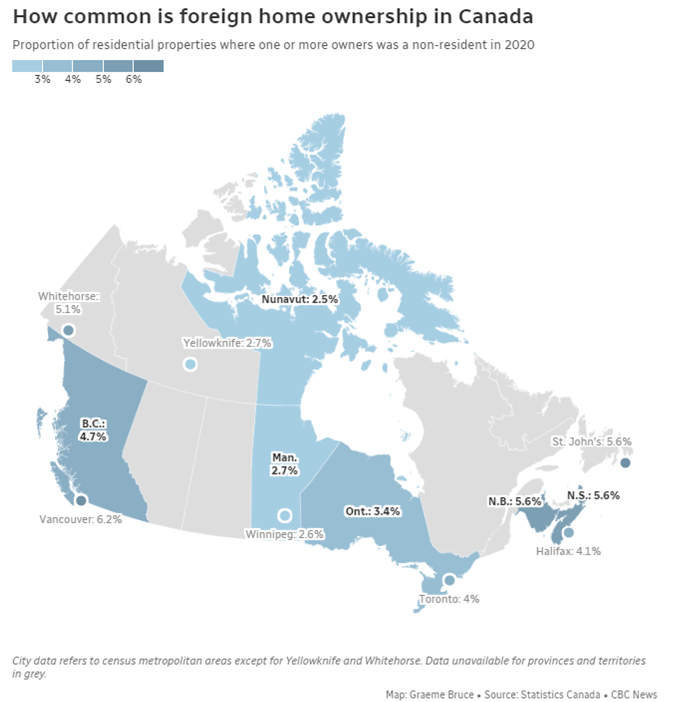

The ban may not do much to calm prices in Canada, we saw such a huge influx of buyers into the market due to low interest rates and a low supply of homes to purchase. The number of foreign buyers in BC specifically is quite low. In 2020 the number of residential properties where one or more owners were a non-resident was 4.7%. In 2021 that dropped to 1.1%.

The ban on foreign buyers is for two years. If any person or entity that knowingly assists a non-Canadian in the purchase of a property they can be fined up to $10,000 and the property may be forced to be sold.