This article appeared on the Vancouver Sun on July 16th, 2011 and was written by Bryan Yu.

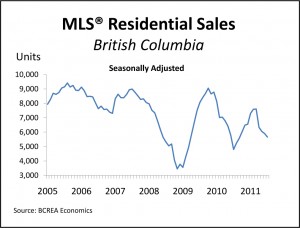

Provincial home sales recorded a third straight monthly decline in June, falling 2.9 per cent from May to a seasonally-adjusted annualized rate of 70,280 units. In spite of a two-per-cent increase over the same period last year, sales remain weak.

June’s decline largely reflected a 5.5-per-cent drop in Metro Vancouver figures as combined sales in the rest of the province rose 3.8 per cent from May. The largest gains were seen in Kootenay (20.6 per cent), South Okanagan (15.7 per cent) and Chilliwack (16.5 per cent) real estate board regions. In the Okanagan-Mainline region, sales rose 4.2 per cent in June following a 9.4 per cent advance the previous month.

While it’s too early to predict a recovery phase, the outlook for the Okanagan and Kootenay markets has improved slightly. High oil prices continue to boost Alberta’s economy and have led to some of the lowest unemployment rates and the strongest pace of job growth in the country. This could bode well for B.C.’s recreational housing markets over the next few years as discretionary spending picks up.

However, a high Canadian dollar and dramatic price declines in some markets south of the border has made recreational housing in the U.S. a significant competitor for those same dollars.

EXPORTS REBOUND

B.C. exports to international markets rebounded following a drop in April. Total seasonally-adjusted exports rose 17.4 per cent to reach $2.8 billion in May, the highest level seen since late 2008. The underlying trend remains slightly positive (although uneven), but largely reflects higher prices rather than increased physical shipments.

The resource sector led growth in May. Exports of industrial goods and materials reversed April’s 33-percent drop, advancing 27.2 per cent to $562.7 million, while energy exports surged 46 per cent from April to $918.8 million.

There was a sharp rebound in natural gas exports to the U.S. and a 32-percent rise in bituminous coal exports from April, reflecting increased shipments to the U.K, China, Brazil and South Korea.

HOUSING STARTS FALL BACK

Following a 30-per-cent gain in May, led by a jump in multi-family construction, housing starts fell 25.9 per cent in June to a seasonally-adjusted annualized rate of 23,500 units.

In B.C.’s urban areas (which represent about 90 per cent of total activity), multi-family starts declined 36.2 per cent to 14,100 annualized units. Meanwhile, single-detached starts remained flat, dipping 1.4 per cent to 7,100 units.

While June’s monthly decline was relatively steep, month-to-month comparisons of housing starts are volatile, reflecting the large proportion of apartments and other multi-family dwellings that make up the flow of new housing additions in the province, particularly in Metro Vancouver.

VALUE OF MAJOR PROJECTS RISES TWO PER CENT

Estimated first-quarter combined capital costs of major projects under construction in the province rose two per cent to $63.1 billion, according to the B.C. Ministry of Finance. Major projects are defined as those with capital costs of at least $15 million ($20 million in the Lower Mainland).

The bulk of the net gains were observed in the Kootenay ($877 million), Thompson/Okanagan ($624 million) and the Mainland/Southwest ($669 million) development regions. In contrast, completed projects outpaced commencement of new projects in the Northeast by a margin of $600 million and on the Vancouver Island/ Coastal region by $416 million.

Among the 28 major projects that began construction in the first quarter, the highest valued project was the Waneta power plant expansion in Trail, with estimated capital costs of $900 million. Work also started on the Interior Heart and Surgical Centre in Kelowna ($448 million) and the Surrey Memorial Hospital Emergency Department and Critical Care Tower ($512 million).

While the value of total proposed projects in the pipeline dipped by two per cent to $112 billion in the first quarter, 39 major projects with combined capital cost of more than $2.5 billion were added to the list. The largest proposed project was the Telus Garden Communications Centre in Vancouver, a 22-storey office tower and a 44-storey residential tower with an estimated capital cost of $750 million.

Bryan Yu is an economist with Central 1 Credit Union.