Price Changes Vary Sharply Around the Province, BCREA Survey Finds

This article appeared on the VancouverSun.com and was written by Brian Morton on September 15th, 2011.

Southwestern B.C. and the rest of the province increasingly have little in common when it comes to year-over-year home price changes, according to the latest numbers from the B.C. Real Estate Association.

While residential sales across the province remained stable in August as low mortgage rates were balanced by high numbers of active listings, average prices dropped in the Okanagan and most other interior regions in the past year while rising sharply in Metro Vancouver and the Fraser Valley.

There are many reasons for the price divergence in the two regions, including less migration to the Okanagan, fewer sales of recreational properties and a higher number of active listings there that quell upward pressure on prices, says BCREA senior economist Cameron Muir.

But Muir also noted in an interview that average prices in Metro Vancouver have been “skewed” for some time by the high number of sales of expensive single-detached homes in pricier neighbourhoods, although that’s changing.

“When we look at the Okanagan and the Kootenays, migration to the region is down. More importantly, purchases of recreational properties has not come back to the level we saw before the recession. And the Okanagan and Kootenays are still oversupplied markets.”

While the Metro Vancouver market remains strong, Muir said prices are starting to pull back as the proportion of single detached home sales in tonier neighbourhoods returns to historic norms.

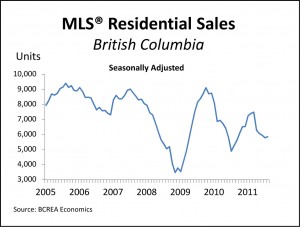

He said that B.C. homes sales edged up one per cent in August compared to July on a seasonally adjusted basis and that low mortgage rates continued to underpin housing demand throughout the province in August.

He said that total active listings in the province remained elevated in August, as “most regional markets exhibited buyers’ market conditions, meaning little upward pressure on home prices.”

According to the BCREA survey, the average price in B.C. rose 10.7 per cent in August compared to August 2010 to $540,000 from $488,000.

However, price changes fluctuated sharply by region, with the Fraser Valley showing the sharpest increase of 19.7 per cent over the year, from $424,000 to $508,000.

Metro Vancouver prices rose 14.4 per cent from $681,000 to $779,000, while Victoria prices rose 13.7 per cent from $472,000 to $537,000. The rest of Vancouver Island showed a slight price drop.

However, Powell River showed the sharpest drop – 12.7 per cent, from $297,000 to $260,000 – while the Okanagan Mainline recorded a 0.3-per-cent drop in prices from $384,000 to $383,000 and the South Okanagan dropped 7.2 per cent from $331,000 to $307,000.

Year-to-date, it was more of the same, with B.C. recording a 14.7-per-cent price increase in the first eight months compared to the same period in 2010, Metro Vancouver recording a 19.2-per cent hike over that period and the Fraser Valley seeing a 12.6-per-cent increase.

However, the Okanagan Mainline saw a 2.5-per-cent decline in the six-month period and the South Okanagan recorded a 5.4-per-cent drop in prices.

Powell River saw an eight-per-cent drop in the six months, while Victoria recorded a 0.5-per-cent decline in the average price.

The Kootenay region recorded a 4.4-per-cent increase in August compared to August 2010, from $274,000 to $286,000, although the average price fell 3.5 per cent year-to-date.

The BCREA also said that the number of residential units sold in August compared to August 2010 rose 16.4 per cent, from 5,590 to 6,504.

To date, B.C. home sales have totalled $31.7 billion this year, up 17.7 per cent from 2010.

average MLS® residential price climbed 10.7 per cent to $539,953 last month compared to August 2010.

average MLS® residential price climbed 10.7 per cent to $539,953 last month compared to August 2010.