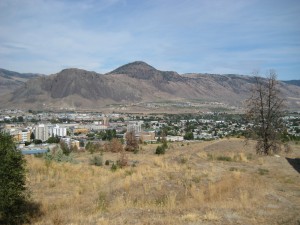

Kamloops Leads Pack for Small Business Growth in Province, Real Estate-Related Enterprises Leading the Charge, Research Analyst Says

This article appeared in the Vancouver Sun on October 5, 2011 and was written by Jenny Lee.

“Real estate seems to be the big driver,” said Mark Eversfield, a research analyst at Small Business BC. “Construction was also busy there.”

Kamloops added 412 new businesses, a six-per-cent increase, between June 2010 and June 2011. By comparison, Vancouver added 5,733 new businesses, up three per cent.

Not surprisingly, real estate agents led the charge in Kamloops, with 93 new businesses in the 12 months, but 83 were owner-operated. The city added 49 retail stores for the year ending June 2011, including 21 retail stores with fewer than five employees. Other growing sectors in Kamloops include health care, agriculture, forestry, fishing, hunting, business services, accommodation, food services, finance and insurance.

“I’m not sure why Kamloops would rank No. 1,” said Helmut Pastrick, chief economist at Central 1 Credit Union. “It does stand out in contrast to some other economic numbers suggesting that the Kamloopsarea economy is struggling somewhat.”

Business incorporations and labour market data for the Thompson-Nicola Regional District – which includes Kamloops – are weak, Pastrick said. The number of employment insurance beneficiaries continues to decline this year, but it’s not clear whether this is due to successful job searches or expired claims. Business incorporations in this regional district are running below last year, he said.

“Lower Mainland employment growth is up 1.7 per cent this year,” Pastrick said. “Metro Vancouver is up 2.1 per cent, compared to 0.3 for Thompson-Okanagan, -3.4 per cent for Vancouver Island, 0.5 per cent in the Kootenays and 1.3 per cent in the Cariboo.”

In the Thompson-Okanagan, which includes Kamloops, Kelowna and other cities, unemployment averaged 8.3 per cent from January to August of 2011.

Meanwhile, the Statistics Canada/Small Business BC data shows Victoria was the second-fastest-growing community for small business locations between June 2010 and June 2011, registering 3.3 per cent growth. There were 544 new real estate businesses, of which 527 had no employees. Other growth sectors were health, insurance and finance, professional, scientific, technical service and retail.

Real estate also led in Penticton, which grew 3.1 per cent over the period. Other growth came from professional, scientific and technical service business, agriculture, forestry, fishing, hunting and construction.

Cranbrook was the small business growth leader last year, increasing 5.2 per cent between June 2009 and June 2010, Eversfield said.

Great downtown condo in prime location. North East facing top floor 2 bedroom, 1 bathroom unit with open concept living. Beautiful 180 degree views of river, downtown and mountains. Very well maintained home with private patio, in suite laundry & storage, central air, secure parking and all appliances included. Sliding glass doors to covered patio with natural gas hook up. Access to patio off of 2nd bedroom and living room. Steel and concrete constructed building with elevator. 1 dog or 1 cat under 20 lbs permitted, rental restriction and 1 covered parking space included. Seconds to all downtown amenities, shopping, transportation, restaurants, YMCA, parks and schools. Quick possession.

Great downtown condo in prime location. North East facing top floor 2 bedroom, 1 bathroom unit with open concept living. Beautiful 180 degree views of river, downtown and mountains. Very well maintained home with private patio, in suite laundry & storage, central air, secure parking and all appliances included. Sliding glass doors to covered patio with natural gas hook up. Access to patio off of 2nd bedroom and living room. Steel and concrete constructed building with elevator. 1 dog or 1 cat under 20 lbs permitted, rental restriction and 1 covered parking space included. Seconds to all downtown amenities, shopping, transportation, restaurants, YMCA, parks and schools. Quick possession. Cutting lot prices at Tobiano in half may still be insufficient to sell property at the resort, according to information contained in a B.C. Supreme Court ruling.

Cutting lot prices at Tobiano in half may still be insufficient to sell property at the resort, according to information contained in a B.C. Supreme Court ruling.