B.C. Home Sales Edge Higher in September

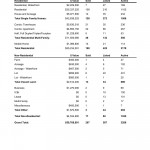

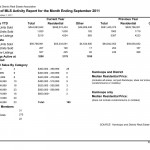

Vancouver, BC – September 14, 2011. The British Columbia Real Estate Association (BCREA) reports that Multiple Listing Service® (MLS®) residential unit sales in the province rose 8.8 per cent to 5995 units in September compared to the same month last year. The average MLS® residential price increased 6 per cent to $523,568 last month compared to September 2010.

“MLS® home sales edged up 3 per cent in September compared to August on a seasonally adjusted basis,” said Cameron Muir, BCREA Chief Economist. “Housing demand last month was bolstered by persistent low mortgage interest rates and a surge in employment.”

“Despite a modest gain in unit sales, total active residential listings in the province remained elevated in September,” added Muir. A total of 55,616 homes were listed on the MLS® in the province at the end of September.

Year-to-date, BC residential sales dollar volume increased 17.5 per cent to $34.8 billion, compared to the same period last year. Residential unit sales increased 3.2 per cent to 61,127 units, while the average MLS® residential price rose 13.9 per cent to $569,922 over the same period.

This article came from The Real Estate Centre and was written on October 4th, 2011.

This article came from The Real Estate Centre and was written on October 4th, 2011.