Too Tight? The Impact of Bank of Canada Tightening on BC Housing Markets: BCREA

This report was released by the BC Real Estate Association on January 18, 2022. The report discusses the implications on the BC real estate market should the Bank Of Canada increase the interest rates. This is only a “best guess” scenario as we have found that markets will do their own thing based on the local conditions (ie low inventory vs demand). Read the summary below or click the link below to read the full report.

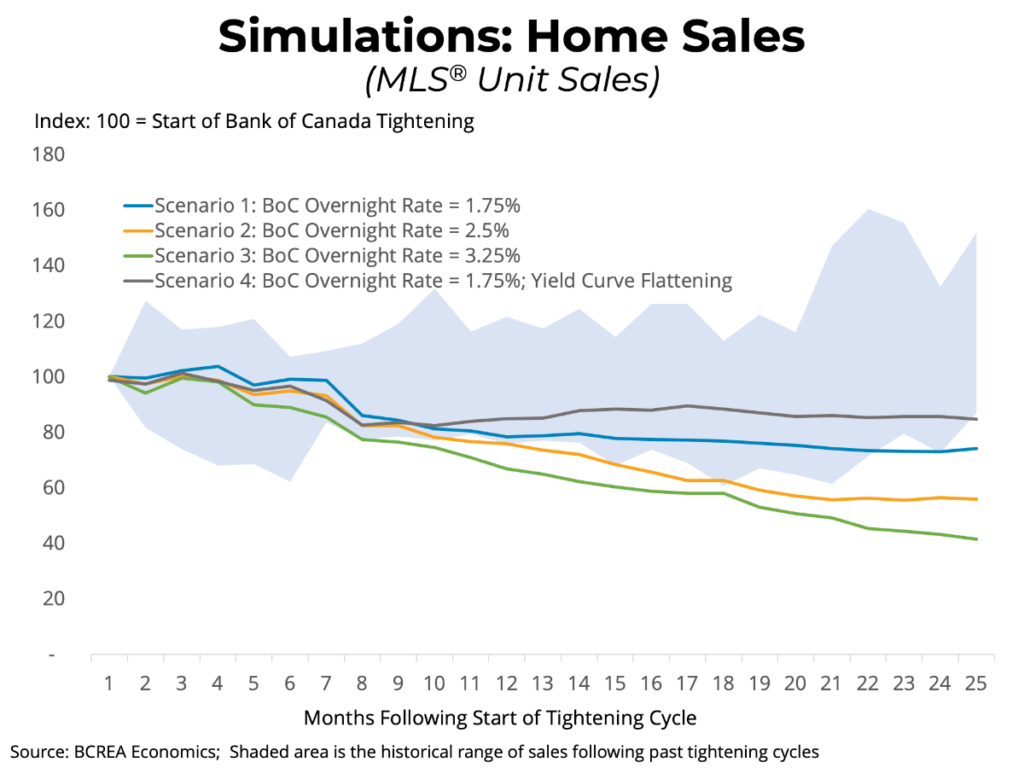

Later this year, the Bank of Canada is widely expected to embark on its first interest rate tightening cycle since 2018. In this Market Intelligence, Too Tight? The Impact of Bank of Canada Tightening on BC Housing Markets, we will consider how high interest rates might rise and using both historical data and model simulations, we analyze how BC housing markets may be impacted.

Click here to read the full report.

Summary Findings:

- The Bank of Canada is signalling that in response to elevated Canadian inflation, it will begin raising its policy rate or “tightening” monetary policy this year.

- Historically, Bank of Canada tightening has led to falling home sales and flattening home prices.

- With markets so out-of-balance, it will take a substantial decline in demand to return active listings to a healthy state.

- Model simulations show that the most likely outcome of this round of Bank of Canada tightening will be home sales falling to near their historical averages and for home price growth to moderate, but because of severely low supply, it is unlikely to result in significant home price declines.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.