The Canadian Real Estate Association Boosts Annual Resale Housing Forecast for 2011

The Canadian Real Estate Association released this article on February 8th, 2011. Click on the images below to enlarge.

OTTAWA – February 8, 2011 – The Canadian Real Estate Association (CREA) has revised its 2011 forecast for home sales activity via the Multiple Listing Service® (MLS®) Systems of Canadian real estate Boards and Associations, and extended it to 2012.

“Home buyers recognize that low mortgage interest rates represent a once in a lifetime opportunity. At the same time, they expect that rates will rise, so they’re doing their homework in order to understand what it could mean in terms of higher mortgage payments down the road before they make an offer,” said Georges Pahud, CREA President. “The housing market and buyer psychology is different now than it was at the beginning of last year, so buyers and sellers would do well to consult their REALTOR® to understand local market trends.”

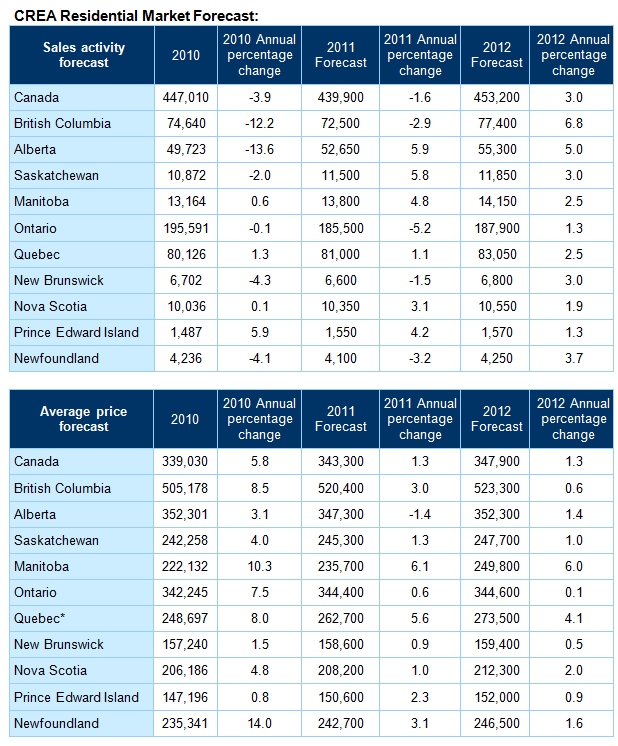

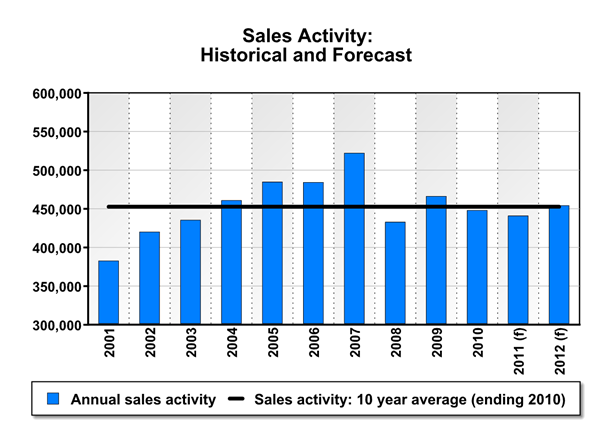

The upward revision to CREA’s forecast for 2011 reflects recent improvements in the consensus economic outlook and a further expected improvement in consumer confidence. National sales activity is now expected to reach 439,900 units in 2011, representing an annual decline of 1.6 per cent. In 2012, CREA forecasts that national sales activity will rebound by three per cent to 453,300 units, which is roughly on par with the ten year average.

“Recent additional changes to mortgage regulations will further ensure that buyers don’t buy more home than they can afford when interest rates inevitably rise,” said Klump. “The announcement of the new changes to mortgage regulations will likely bring forward some sales into the first quarter that would have otherwise occurred later in the year, particularly in some of Canada’s more expensive housing markets. This is expected to produce a milder version of the volatility in sales activity that we saw last year which resulted from additional transitory factors.”

Three transitory factors contributed to volatility in sales activity last year: changes in mortgage regulations announced last February, the early withdrawal by the Bank of Canada of its conditional commitment to keep interest rates on hold until the second half of 2010, and the introduction of the HST in BC and Ontario during the summer of 2010.

CREA expects that home sales activity will gain traction after dipping in the second quarter as the economic recovery and job growth continue, incomes grow, and consumer confidence further improves. “Even though mortgage interest rates are expected to rise later this year, they will still be within short reach of current levels and remain supportive for housing market activity. Strengthening economic fundamentals will keep the housing market in balance, which will keep home prices stable,” said Klump.

The national average home price is forecast to rise 1.3 per cent in 2011 and 2012, to $343,300 and $347,900 respectively. Average price is expected to rise modestly in most provinces, reflecting the continuation of a healthy balance between supply of, and demand for, homes listed for sale. Although the supply of new listings is expected to trend higher, the expected continuation of sellers’ market conditions in Manitoba is forecast to result in a bigger percentage increase in average price in 2011 and 2012 compared to other provinces.

http://www.fciq.ca/immobilier-economiste.php

Higher interest rates could “easily” cause Canadian home prices to collapse,

Higher interest rates could “easily” cause Canadian home prices to collapse,