BC Housing Markets Bounce Back in June, BCREA

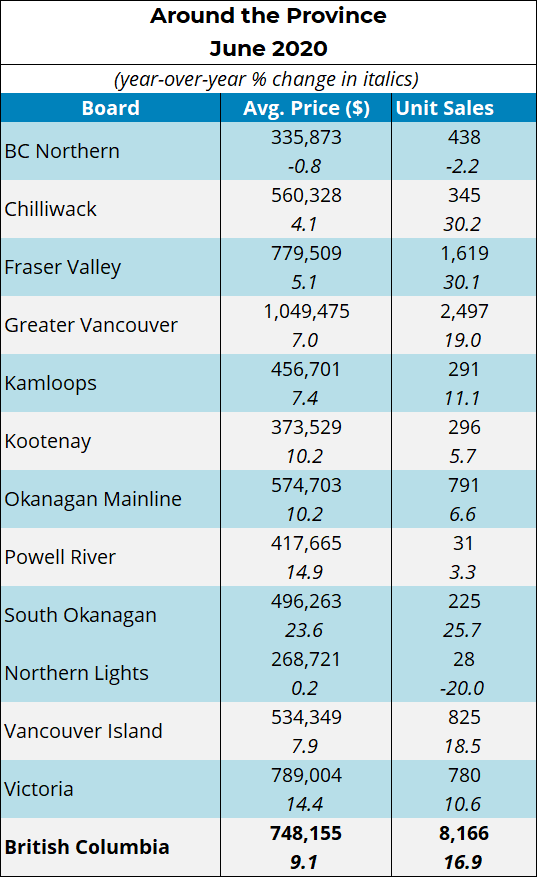

Vancouver, BC – July 14, 2020. The British Columbia Real Estate Association (BCREA) reports that a total of 8,166 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in June 2020, an increase of 16.9 per cent from June 2019. The average MLS® residential price in BC was $748,155, a 9.1 per cent increase from $685,968 recorded the previous year. Total sales dollar volume in June was $6.1 billion, a 27.5 per cent increase over 2019.

“Sales around the province surged back to pre-COVID-19 levels in June,” said BCREA Chief Economist Brendon Ogmundson. “While there are some temporary factors that may have pushed demand forward, we are cautiously optimistic that market activity will remain firm.”

Although listings activity has normalized along with sales, active listings are still down close to 20 per cent year-over-year and, as a result, many markets are seeing upward pressure on prices.

Year-to-date, BC residential sales dollar volume was up 0.6 per cent to $24.7 billion, compared with the same period in 2019. Residential unit sales were down 8 per cent to 32,875 units, while the average MLS® residential price was up 9.4 per cent to $751,722.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

Brighton Place is located at 1323 Kinross Place in the

Brighton Place is located at 1323 Kinross Place in the

I had the opportunity today to be part of a webinar discussing the new BC Home Partnership Program for first time home buyers. After being presented with the information in the webinar it is fairly straight forward and easy to understand from an experienced Realtor’s perspective. I could also see that first time home buyers in Kamloops may need some help and direction navigating the entire process. I thought it was important to create a guide to help buyers understand how the program works and where to start. There were also a number of points that were brought up in the webinar that I feel are important to consider.

I had the opportunity today to be part of a webinar discussing the new BC Home Partnership Program for first time home buyers. After being presented with the information in the webinar it is fairly straight forward and easy to understand from an experienced Realtor’s perspective. I could also see that first time home buyers in Kamloops may need some help and direction navigating the entire process. I thought it was important to create a guide to help buyers understand how the program works and where to start. There were also a number of points that were brought up in the webinar that I feel are important to consider.