BCREA Mortgage Rate Forecast March 2024

BCREA has released it’s latest Mortgage Rate Forecast for March for 2024. They outline the main highlights as:

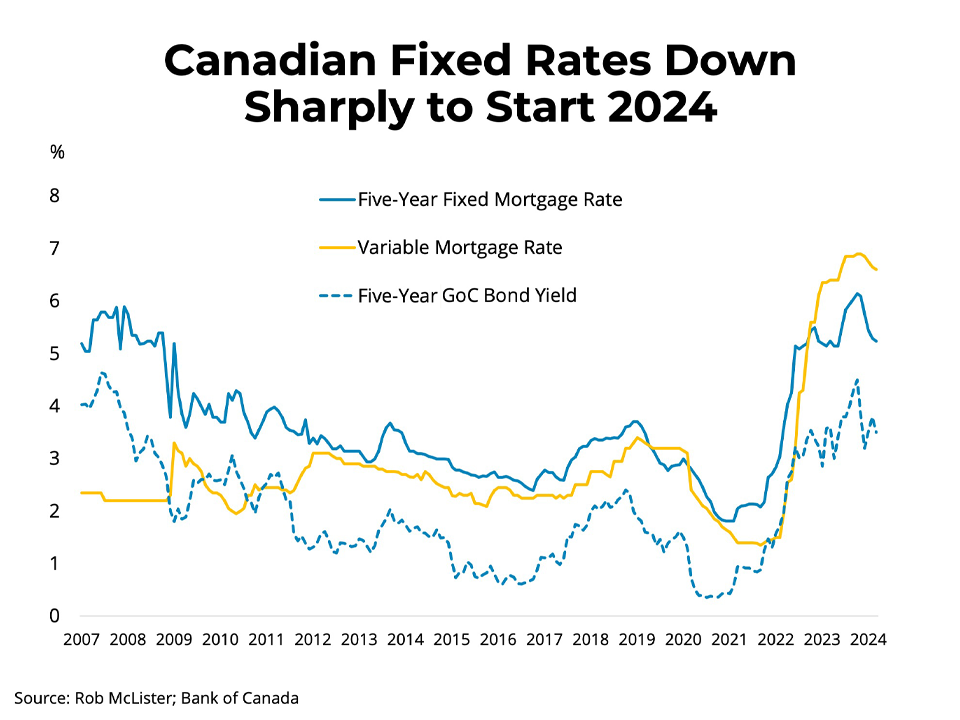

– Canadian mortgage rates down sharply to start 2024.

– The Canadian economy – no recession yet, but growth is very slow.

– Waiting for the Bank of Canada to cut.

Click Here to download the full document. The report is summarized below.

Mortgage Rates

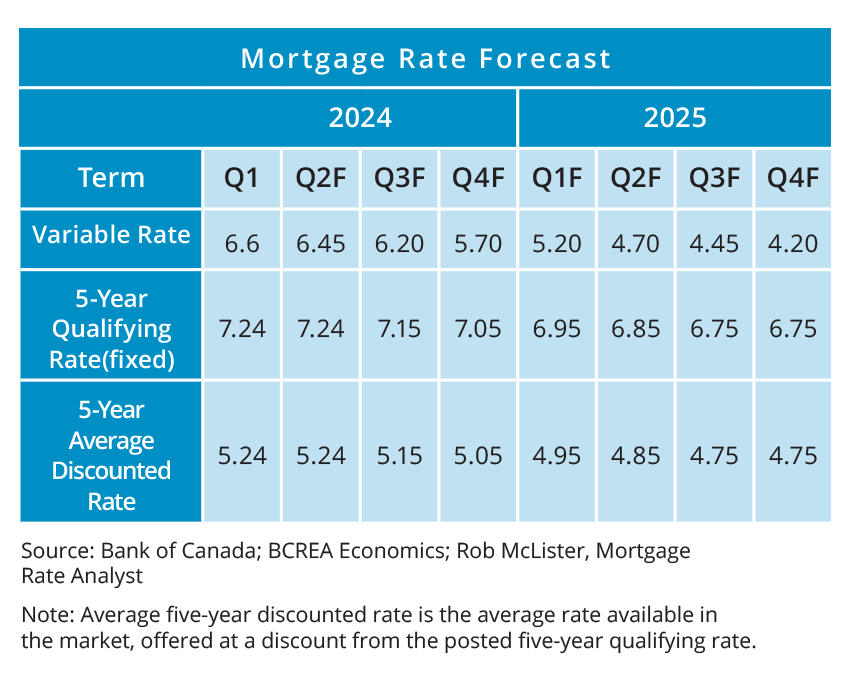

In early October 2023, Canadian five-year bond yields reached a 17-year high at 4.42%. However, within four weeks, they dropped by more than 100 basis points. This significant swing in borrowing costs was triggered by better-than-expected inflation data in both the US and Canada, starting in early fall and continuing through the end of 2023. Consequently, financial markets adjusted their expectations for the timing and extent of monetary easing by the Bank of Canada towards more aggressive rate cuts in the future.

Although bond yields rose slightly in February after the initial drop, the current trend suggests a five-year fixed mortgage rate of approximately 5.2%, which is close to the current average offered rate by major lenders and not far from the anticipated rates by the end of 2024. Discounts on variable rates have increased from prime minus 30 basis points to prime minus 60 basis points, leading to a slight decline in average variable rates. However, a more significant decrease in variable rates is anticipated to occur once the Bank of Canada initiates rate cuts.

Economic Outlook

The Canadian economy narrowly avoided a technical recession in the fourth quarter with meager growth. However, various indicators suggest a fragile economy. Falling real GDP per capita and negative growth in Private Domestic Demand indicate underperformance. Though real gross domestic income recently returned to positive territory, it remains a concern. Despite this sluggishness, the labor market shows surprising resilience. Job growth, though not matching population expansion, persists, with over 40,000 jobs added in February. The national unemployment rate remains steady at around 5.8%, close to pre-pandemic levels. Additionally, wage growth has exceeded 5% for the past three months, significantly outpacing inflation.

Bank of Canada Outlook

Financial markets exaggerated expectations at the end of 2023, pricing in six rate cuts by the Bank of Canada, which is unlikely. However, it’s highly probable that the Bank will start lowering its policy rate this year, with consensus suggesting a cut of up to 2.5%, or 250 basis points. The timing of the first rate cut remains uncertain, but markets heavily favor a 25 basis point cut at the June meeting, with over a 90% probability of a total 100 basis points cut by December. The Bank’s decision in March emphasized the need for progress in bringing core inflation below 3% to avoid premature actions. Considering the significant drop in core inflation in February and the sluggish economy, an April rate cut is plausible, and if not April, then almost certainly June.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.