BCREA Mortgage Rate Forecast for September 2023

Highlights:

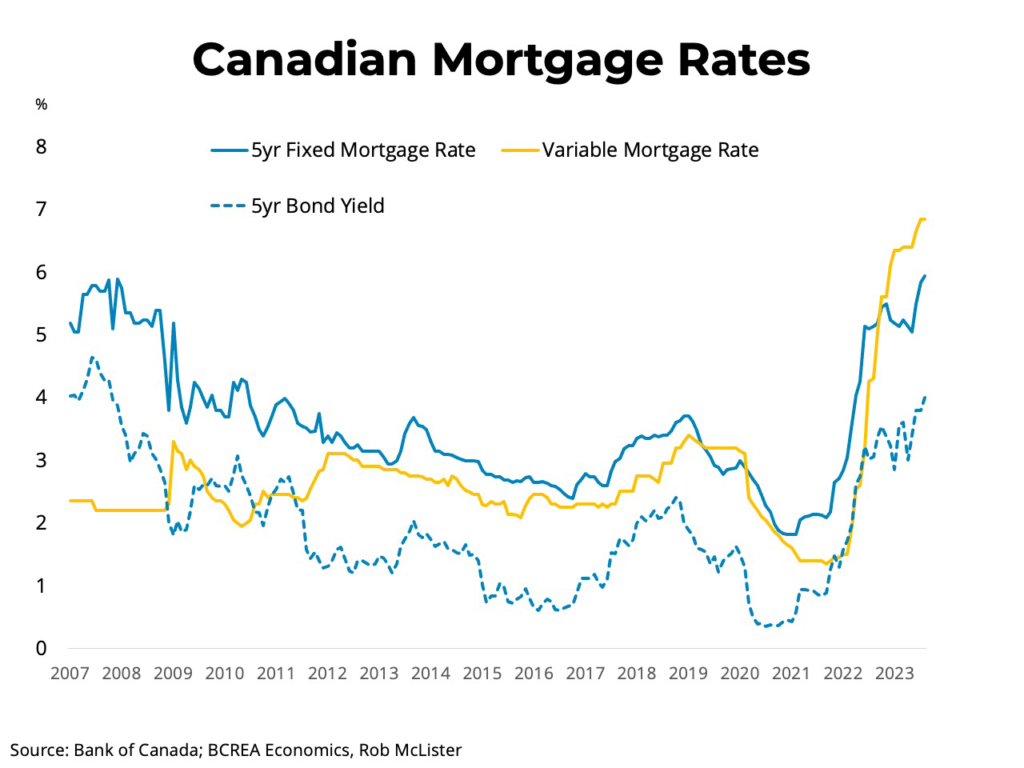

- Bank of Canada tightening sends mortgage rates to 15-year highs

- Are high rates finally impacting economic growth?

- How far will fixed mortgage rates fall once the Bank of Canada lowers its policy rate?

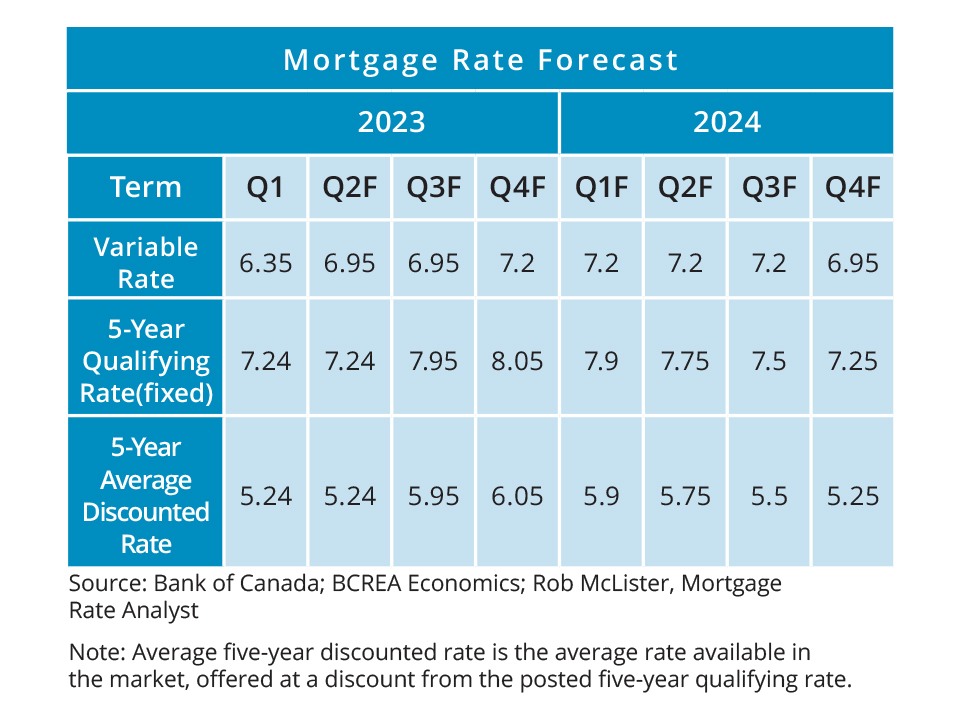

BCREA has released the latest mortgage rate forecast. The Bank of Canada raised the rates both in June and July due to a more brisk real estate market and inflation being hotter than expected in the spring. This has created a shift in expectations where it was thought that we may see rates come down in 2024 or 2025. Fixed rate mortgages have hit an annual high approaching 6%. Even though the economy is slowing inflation is still hovering around 3 to 4%. Inflation is not expected to return to a more normalized level until 2025.

To view the September 2023 Mortgage Rate Forecast PDF, click here.

For the complete news release, including detailed statistics, click here.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.