BCREA Mortgage Rate Forecast for December 2023

Highlights:

– Benchmark five-year bond yields tumbling, fixed mortgage rates to follow.

– The Canadian economy slowed sharply in the third quarter.

– The Bank of Canada is set to cut in 2024, but how much and how fast?

To view the December 2023 Mortgage Rate Forecast PDF, click here.

Mortgage Rate Outlook

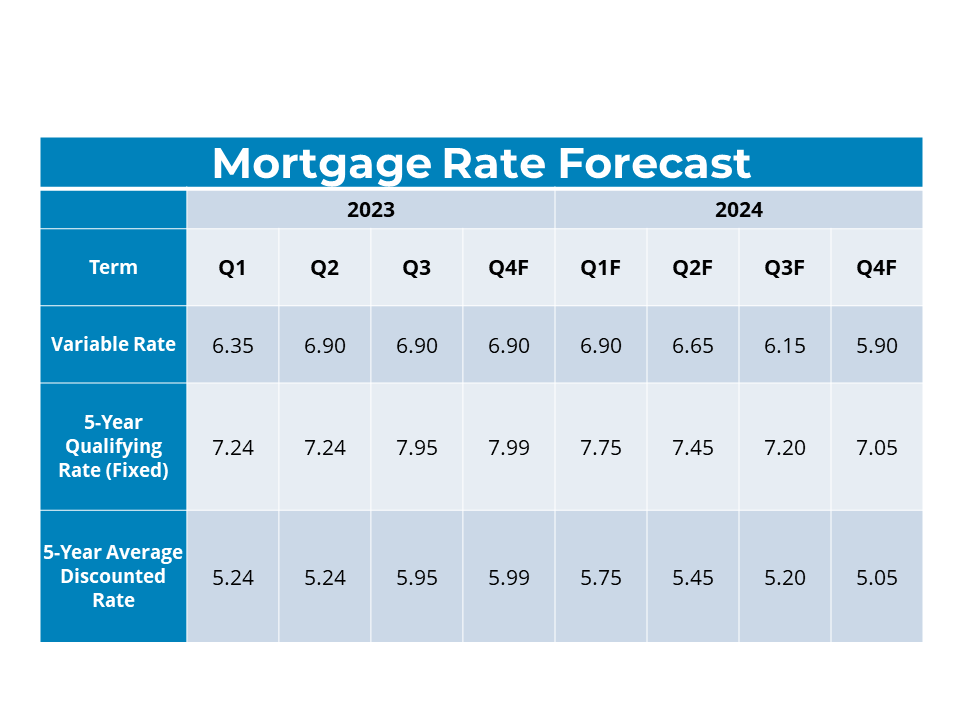

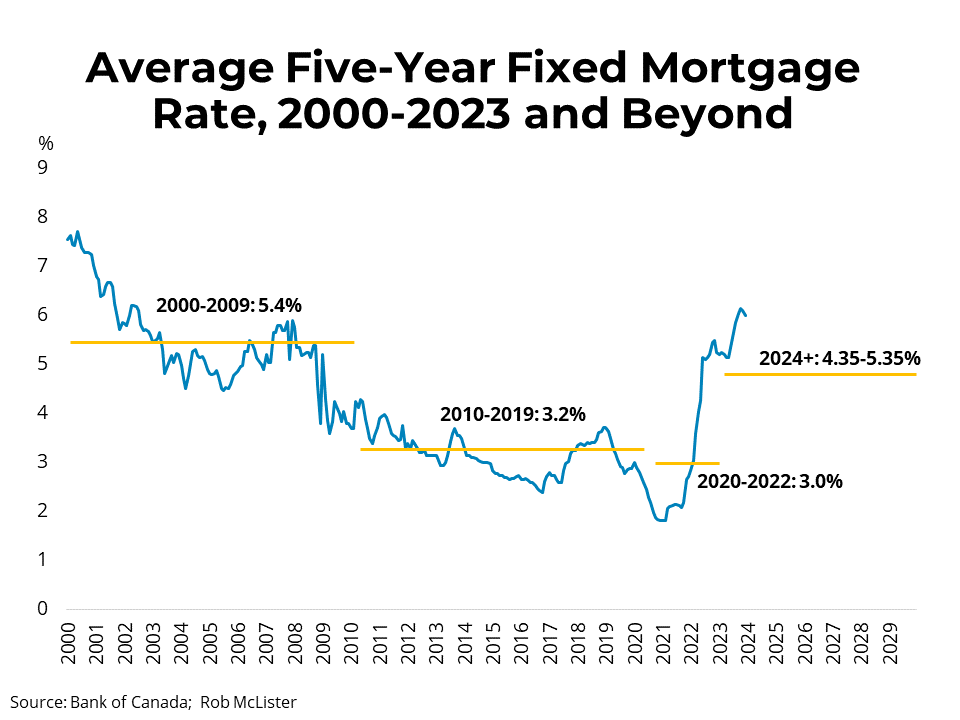

After hitting a 15-year high in late fall, long-term Canadian bond yields have been tumbling to finish the year as financial markets reckon with slowing inflation and the projected end of central bank rate hikes. The five-year Government of Canada bond yield has trended near 3.5 per cent over the last several weeks, and if that level sustains, we will see a meaningful decline in five year fixed mortgage rates to start 2024. Our forecast is for the average five-year fixed mortgage rate to fall to

5.05 per cent by the end of 2024, while variable rates will start falling as the Bank of Canada lowers its overnight rate starting in the first or second quarter.

The ultimate destination for mortgage rates, however, is likely much higher than homeowners or prospective buyers have become accustomed to over the past decade. Indeed, if the Bank of Canada lowers its policy rate to the mid-point of its preferred 2 to 3 per cent range, that would imply a long-run five-year fixed mortgage rate of 4.85 per cent and an associated qualifying rate of 6.85 per cent. In contrast, the average five-year fixed mortgage rate since 2010 has been closer to 3 per cent.

Economic Outlook

Canadian GDP was weaker than expected in the third quarter, declining by 1.1 per cent on an annual basis. At the same time, Statistics Canada revised its second quarter GDP figure considerably upward, indicating that the economy has again avoided entering a technical recession. With October’s preliminary figure again positive, the Canadian economy appears weak but is not shrinking substantially in aggregate terms so far.

While the economy has been surprisingly resilient, there are significant challenges in 2024 that pose a risk to economic growth. First, several interest rate-sensitive types of spending and investment, such as purchases of vehicles and tourism, benefited from pent-up demand following the pandemic. Those sectors will likely see much slower expenditures in 2024. Additionally, while residential investment has held up well this year, high borrowing costs will likely delay development next year.

Second, a wave of mortgage rate renewals for both variable and fixed-rate payers over the next two years will cause a significant increase in monthly payments, necessitating a slowdown in other discretionary consumer spending. That said, the Canadian economy may have weathered the worst of the potential rate impacts on growth and could soon be benefiting from falling rates if progress on inflation continues. As a result, a soft landing for the economy, in which inflation returns to normal without a significant sacrifice in the way of output employment, is increasingly probable.

Bank of Canada Outlook

Given the evidence of a slowing economy and some long-awaited downward momentum in core inflation, it appears likely that the Bank of Canada’s rate-tightening cycle is at an end. If so, the conversation around Bank of Canada meetings in 2024 will shift toward when the Bank might lower rates and how quickly. Given that the Bank’s estimate for its neutral rate is between 2 and 3 per cent, we can expect between 200 and 300 basis points of rate cuts once inflation has reliably returned to its 2 per cent target.

Although material progress has been made in returning inflation to normal, price growth in some areas of the economy appears more challenging to tame. Housing costs, which are a substantial proportion of the CPI basket, continue to appreciate too quickly. Mortgage interest costs have been rising at a 30 per cent rate, propelled higher by the Bank of Canada’s aggressive tightening. However, the year-over-year impact of high mortgage rates will fade in 2024. What may be more persistent is inflation stemming from the rental market. With so much demand from not only a surge in immigration but also a stress test that is keeping would-be buyers in the rental market, combined with very little ability to increase supply quickly, rents will likely continue to grow at an elevated rate in the coming year. Those factors will probably

keep inflation above 2.5 per cent in 2024 and prevent the Bank from lowering rates at a faster pace. Consequently, we expect the Bank will begin lowering rates in the spring, ultimately cutting 75 to 100 basis points by the end of the year and

200 basis points by the end of 2025.

For the complete news release, including detailed statistics, click here.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

“Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.