This article was written by Sunny Freeman and appeared on the Globe and Mail website Tuesday, December 14th, 2010.

Preet Bharati was nervous about plunging into home ownership this year after hearing of bidding wars and stiff competition for overpriced homes – but when she began house-hunting this summer she was relieved to find the buying spree of early 2010 had run its course.

“We ended up getting our house for under the asking price,” the 30-year-old new Mississauga, Ont. homeowner explained of her shock at securing her chosen house in June. “It was a little bit surprising because the feedback that I was getting from friends of mine, when they were looking, every offer was way above the asking price.”

As Ms. Bharati discovered, 2010 was a tale of two housing markets. However, the year of wild twists and turns is expected to be followed up by a 2011 performance that economists sum up in one word: boring. “The housing market is going to become a lot more boring place,” says Gregory Klump, chief economist at the Canadian Real Estate Association. “Boring is something that both buyers and sellers can look forward to after the crazy roller-coaster ride that we’ve been on since the depths of the recession in 2008.”

The opening months of 2010 saw panicked buyers and overvalued homes in a market that heavily favoured sellers. A rebound in consumer confidence and pent-up demand from the recession, combined with record low interest rates of 0.25 per cent and impending tax policy changes to condense sales into a short period when Canadian home sales and prices soared to record heights.

Sellers took longer than buyers to regain confidence, causing a delay in getting inventory on to the market.

Open houses were packed, sellers received multiple offers over asking prices and buyers engaged in bidding wars to secure a home while mortgage rates were low. That sent the average home price skyrocketing.

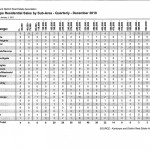

That unsustainable surge in sales, and the ensuing sharp turnaround, led to a “whiplash effect” around the middle of the year – a rare phenomenon that won’t be repeated in subdued 2011, says Phil Soper, president and CEO of Royal LePage. “The big story would have been the dramatic surge in activity level and we’re paying for it now,” Soper says. “It was a highly front-end loaded year,” he says, adding that 60 per cent of activity took place in the first half of the year, compared to an average 55 per cent.

As home prices continued their upward trajectory despite faltering sales, economists, including the head of the central bank, asked questions about home affordability and how consumers would fare when interest rates inevitably rise.

Canada’s overheated housing market caused debate about whether the foreclosure crisis that has caused so much grief for homeowners south of the border could happen in Canada. However, most Canadian real estate experts dismissed the notion of a Canadian housing bubble. “It shouldn’t have gotten the kind of attention it did,” Mr. Soper says. “There was nothing to fear in terms of a sustained double digit price increase, it really just lasted a couple of months and settled back down.”

In the end, the effects of policy changes were minimal and interest rates will end the year at a still low one per cent, but the anticipation of bigger changes caused buyers to panic, says Adrienne Warren, a senior Scotiabank economist. “There was a large degree of perception of people wanting to get in at the right time in the market. But unfortunately in some cases it was not the right time in the market when everyone’s rushing to get in and it leads to bidding wars,” she says.

The upward momentum reversed in April when demand that pulled sales ahead began to dwindle just as Bank of Canada governor Mark Carney lifted a pledge to keep interest rates at rock bottom. April also ushered in more stringent mortgage qualification rules aimed at discouraging homeowners from taking out mortgages on homes they might not be able to afford down the road.

By early spring, inventories returned as homeowners saw the high prices sellers were fetching for their homes and started listing their homes. The market balanced out between buyers and sellers and prices peaked at $346,881 in May.

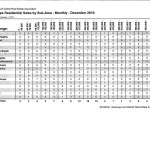

Monthly sales declined in the summer, usually the busiest time of year, after Mr. Carney raised interest rates for the first time in a year in June, albeit by a modest 0.25 per cent. He followed up with incremental raises in subsequent announcements in July and September.

Sales reached a trough in July, the month the harmonized sales tax regime took effect in the country’s hottest housing markets, Ontario and B.C. Existing home sales tumbled nearly 30 per cent from a peak of 521,148 in January to 378,258 in July. By comparison, sales in an average year are much flatter on a monthly basis and tend to hover between 450,000 and 500,000 consistently.

Construction and pricing on new homes followed a similar pattern, but lagged the resale market as contractors adjusted new building to the reduced level of demand to avoid a glut of empty homes on the market.

The market has stabilized after bottoming out in July with the most recent data showing three consecutive monthly increases since. Still, the first half of 2010 is going to cast a long shadow over the next year, says Mr. Klump, making it difficult for sales in the first half of 2011 to outpace year-on-year comparisons.

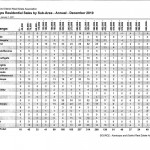

CREA projects a 4.9 per cent slide in sales this year and nine per cent next year. The drop is tied to lacklustre economic and job growth, weak consumer confidence and interest rate hikes that are expected to resume next year. However, it said average home prices are expected to rise by 3.1 per cent across the country this year, reaching $330,200. Next year, prices are projected to fall by 1.3 per cent to a national average of $326,000, tied to weakness in British Columbia and Ontario.

In a highly competitive real estate market it can be difficult to determine who the best Real Estate Professional would be for your needs. Currently the Kamloops and District Real Estate Association reports that there are just under 300 member Realtors. I have included some pointers below to help you figure out how to find the right professional for you.

In a highly competitive real estate market it can be difficult to determine who the best Real Estate Professional would be for your needs. Currently the Kamloops and District Real Estate Association reports that there are just under 300 member Realtors. I have included some pointers below to help you figure out how to find the right professional for you.