B.C. Home Sales and Average Prices Rise in July

This article appeared on the Vancouver Sun on August 11th, 2011 and was written by Brian Morton.

B.C. home sales rose 12.9 per cent to 6,533 units in July compared to July 2010, while the average price climbed 10 per cent to $541,000, the B.C. Real Estate Association reported Thursday.

However, there was a wide discrepancy in price increases around the province, with Metro Vancouver continuing to show the highest increase.

But price increases in Metro Vancouver are slowing down, and are expected to slow down even further in the coming months.

“In Metro Vancouver, the price numbers have been inflated over the past several months as higher end [single detached] properties selling in pricier neighbourhoods [pushed] the average price higher,” BCREA chief economist Cameron Muir said in an interview. “But this is unlikely to be sustained over the longer term.”

Muir expects the number of single detached homes sold in pricier neighbourhoods like West Vancouver and Vancouver’s west side won’t be as high a proportion as experienced in recent months.

“Three months ago, the average price [in Metro Vancouver] was growing 25 per cent year over year,” he said. “Now, it’s dropped to 16 per cent.”

According to the survey, Metro Vancouver saw a 15.9-per-cent increase in the average price of a residential property in July compared to July 2010, from $658,000 to $762,000. The Fraser Valley recorded a 9.7-per cent increase, from $459,000 to $504,000.

However, the Okanagan Mainline recorded a minuscule 0.5-per-cent increase, from $406,000 to $408,000, while Kamloops saw a 7.6-per-cent decline, from $311,000 to $287,000. Victoria recorded a six-per-cent decline, from $497,000 to $467,000.

Muir noted that housing demand in the near future could be bolstered by lower interest rates as investors flock to bonds and bank analysts predict the Bank of Canada will keep its overnight target rate steady in light of the U.S. Federal Reserve saying it expected that an increase in rates would not be warranted, given the state of the U.S. economy, until 2013.

He said that recent global economic uncertainty means that mortgage rates have the potential to reach record lows in the coming weeks as investors flock into bond markets. “This will mean added purchasing power and affordability for consumers.”

Year-to-date, B.C. residential sales dollar volume increased 16.5 per cent to $28.2 billion, compared to the same period last year. Residential unit sales increased one per cent to 48,628 units, while the average residential price for houses sold through the multiple listings service rose 15.3 per cent to $579,645, BCREA said.

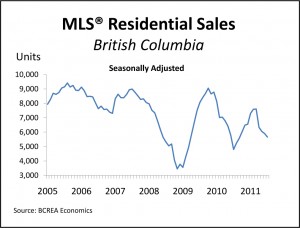

Muir noted that home sales edged down four per cent from June to July on a seasonally adjusted basis. “Less frenetic buying activity in Vancouver operated to pull total provincial sales lower.”