B.C.’s Real Estate Market Looks Good Despite Uncertain Economic Times Ahead

This article appeared on TheStraight.com and was written by Carlito Pablo on August 24, 2011.

On the day Mark Carney appeared before the finance committee of the House of Commons in Ottawa, Miguel Escueta went about his regular routine in Vancouver.

While the governor of the Bank of Canada talked on Parliament Hill about risks associated with the economic crises in the U.S. and Europe, it was business as usual for Escueta, a realtor of several years.

Global equities and financial markets may be wobbly, but according to Escueta, this is keeping interest rates down in Canada. This can only be good for property buyers out to make a move.

“We feel positive about the real-estate market,” Escueta told the Georgia Straight in a phone interview.

Escueta may not see most of the data that Bryan Yu goes through as an economist with the Vancouver-based Central 1 Credit Union, but the latter arrives at practically the same conclusion as the realtor.

“We’ve also seen factors of instability creating downward pressure on bond yield as a lot of investors know there’s so much hesitance to be in the [stock] market,” Yu told the Straight by phone. “What we expect to see, in the short term at least, is that mortgage rates [will] tend to come down further than they already are, and they are already at low levels.”

Yu also predicted a softening of housing prices, though this may not exceed five percent. But he doesn’t foresee a housing crash. “Sellers generally, if the market becomes weaker, they don’t list their properties,” the economist said.

However, Yu pointed out consumer confidence could take a hit in the face of an unstable world economy. With personal investments declining in value, people could pull back on spending on large items like new houses.

The B.C. Real Estate Association has reported that home sales in the province fell four percent from June to July this year. However, the organization is banking on mortgage rates slipping further as a government measure to mitigate the impact of uncertainties in the world economy, giving home buyers more purchasing power.

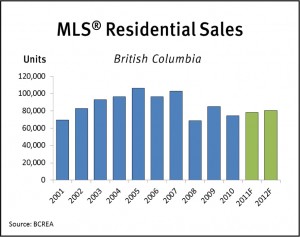

The housing market in the province isn’t immune to economic vagaries, the last of which was the recession of 2008 and 2009. According to BCREA data, total sales dropped 31 percent from 2007 to 2008, to $31.3 billion. The number of houses sold declined by 33 percent to 68,923 units, the lowest since 2000.

Weak sales continued into early 2009. Residential unit sales decreased by 57 percent in January of that year compared to the same month in 2008, with only 2,115 homes sold. But the pace picked up in February 2009. Tracking by Statistics Canada indicated that the economy began to stabilize in mid 2009.

While interest rates are expected to remain low, the federal government will be keeping a close eye on household debt levels. As the central bank’s Carney recalled in his opening statement to the House finance committee on August 19, the government has tightened mortgage rules since 2008 to “support the long-term stability of the Canadian housing market”.

“In an environment of exceptionally low interest rates, we must be careful not to repeat the mistakes of others who now face the challenges of simultaneously lowering unsustainable public and private debt burdens,” Carney stated.

Carney noted that Canadians are “now as indebted as the Americans and the British”.

The volatile global economy isn’t much of a concern to Simon Fraser University’s Andrey Pavlov. According to the associate professor of business, who specializes in real-estate finance, many people are expected to consider parking their money in properties as a safe investment.

“There’s no other place to put your money,” Pavlov told the Straight in a phone interview. “All other investments are suffering a lot.”

What worries Pavlov about the real-estate market in Metro Vancouver is the high prices relative to rent. According to the SFU academic, that could affect the potential for further price increases down the line.

“It doesn’t mean that prices would go down, but future growth of prices from here is hard to see because any investor wants to look at the rent they can collect if they rent their property,” he said. “And that rent is just not very high right now in B.C.”

Beautiful 40.2 acre flat property with a spacious home, numerous out buildings, 15 acres of hay fields, and tons of potential for further development. Louis Creek runs through the property. Recent updates include new laminate flooring, beautiful river rock fireplace,

Beautiful 40.2 acre flat property with a spacious home, numerous out buildings, 15 acres of hay fields, and tons of potential for further development. Louis Creek runs through the property. Recent updates include new laminate flooring, beautiful river rock fireplace,  kitchen countertops, appliances & lino floor, windows, light fixtures, water softener, plumbing, metal roof (2006), deck & railings, gutters, down spouts & facia, hot tub and more. Large 30 X 60 barn with a 10 X 60 storage area in the loft with a second loft area for even more storage (400 sq feet). There are 4 stalls in the barn and has electrical service. Other outbuildings include: animal management building 16 X 16, Wood shed 12 X 16, Green house 16 X 16 with attached 16 X 12 storage, Loafing house 12 X 16 with tack house, poultry coup 20 X 50 with incubators and storage, and a storage shed 12 X 20. The raised garden bed is 24 X 20 great for growing all your veggies in the summer. The hay fields are subirrigated and one of the 7 acre fields yields 2 cuts per year. The shallow well produces more than enough water and owners have never run short.

kitchen countertops, appliances & lino floor, windows, light fixtures, water softener, plumbing, metal roof (2006), deck & railings, gutters, down spouts & facia, hot tub and more. Large 30 X 60 barn with a 10 X 60 storage area in the loft with a second loft area for even more storage (400 sq feet). There are 4 stalls in the barn and has electrical service. Other outbuildings include: animal management building 16 X 16, Wood shed 12 X 16, Green house 16 X 16 with attached 16 X 12 storage, Loafing house 12 X 16 with tack house, poultry coup 20 X 50 with incubators and storage, and a storage shed 12 X 20. The raised garden bed is 24 X 20 great for growing all your veggies in the summer. The hay fields are subirrigated and one of the 7 acre fields yields 2 cuts per year. The shallow well produces more than enough water and owners have never run short.