Realty Rise ‘Defies Logic’, Sales and Prices Increase Despite Economic Volatility

This article appeared in The Province on December 7th, 2011 and was written by Garry Marr.

One of Canada’s leading real estate companies says the rising housing market may not appear to make much sense.

But appearances are deceiving and Re/Max says sales and aver-age prices will continue to climb in 2012 – and that Vancouver’s average house price will break through $800,000.

“Canadian residential real estate defied conventional logic and out-performed expectations in 2011,” the company said in its year-end report on the market.

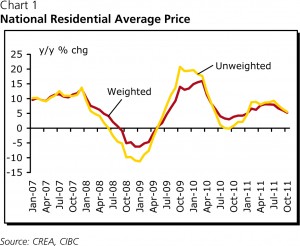

Re/Max expects 2011 to finish with prices up seven per cent and the average home across the country selling for $363,000. The market won’t be as robust in 2012 but consumers can still expect another two per cent jump in prices, it added.

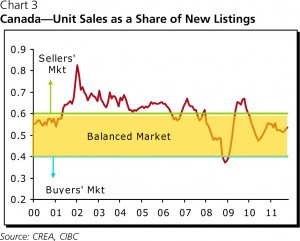

Sales for 2011 are forecast to climb by three per cent from a year earlier with 460,000 homes sold by year end. For 2012, expect less than a one per cent increase in activity with only an addition-al 4,500 sales.

“The Canadian housing market has demonstrated tremendous resilience in recent years but 2011 stands out,” Re/Max spokesman Michael Polzler said. “Residential real estate markets actually experienced an upswing in the volatile third and fourth quarter.”

For Greater Vancouver, the aver-age house price in 2011 will have climbed 16 per cent from 2010 to almost $790,000, Re/Max said.

Sales this year should rise to 32,700 units, up from 31,144 reported last year.

“Given strong underlying fundamentals, the Greater Vancouver residential real estate market is expected to bounce back in 2012,” Re/Max said.

“Sales are forecast to hold relatively steady at 33,000, while [the] average price is projected to climb a further four per cent to $820,000.”

Re/Max looked at 26 markets across the country and predicts 23 will show an increase in aver-age price for this year. Sales were up in 22 of those 26 markets. The company says 81 per cent of markets studied will see price increases in 2012.

Among the reasons cited for the Canadian housing market’s continued strength against the odds has been population growth which has gone up by 11 per cent since 2000.

“Population growth and immigration are major factors expected to prop-up housing demand and household formation in the coming years,” says the company.

Condominiums are expected to continue to garner a growing share of the housing market with investment and income-producing properties in high demand. Low vacancy rates are said to have driven those markets in 2011 and those conditions are expected to continue.

Homes in Canada became a bit more affordable in the third quarter of 2011, according to a new report by RBC. Most parts of Canada saw a decrease in housing costs, with Vancouver being the one exception.

Homes in Canada became a bit more affordable in the third quarter of 2011, according to a new report by RBC. Most parts of Canada saw a decrease in housing costs, with Vancouver being the one exception.