BCREA Mortgage Rate Outlook

BCREA released it’s latest mortgage rate outlook. Read below and link to full report is included below.

The average Canadian 5-year fixed rate has fallen to under 2 per cent, the result of a rapid and overwhelming policy response from the Bank of Canada to the COVID-19 pandemic. The Bank swiftly brought its overnight rate to its effective lower bound of 25 basis points and used the impressive scope of its balance sheet to counteract a nascent rise in credit spreads. Those measures, and those of its global counterparts, helped to forestall a potential repeat of the credit crisis that shocked the global economy over a decade ago.

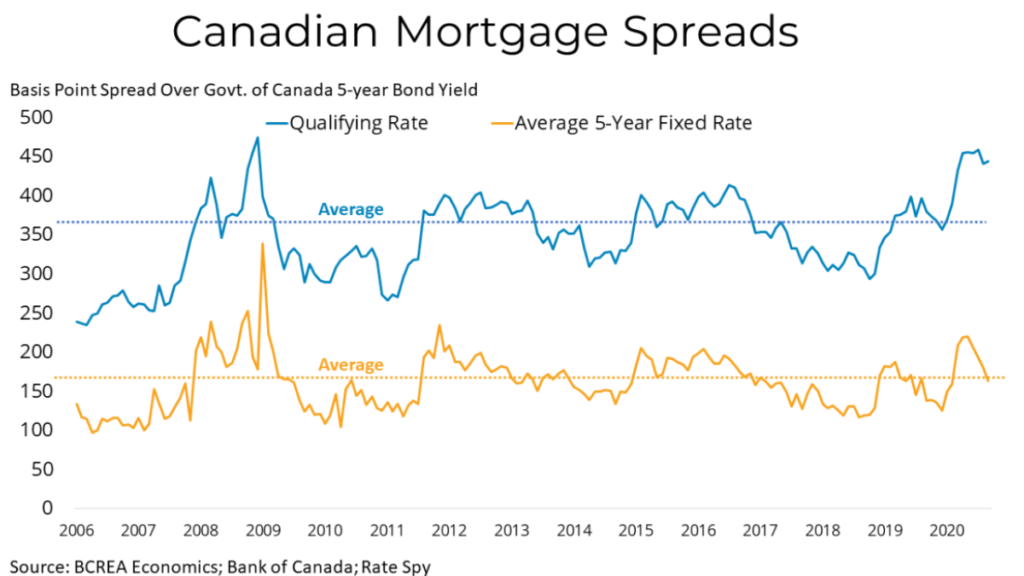

The Bank’s foray into quantitative easing (QE), or the purchasing of bonds across the yield curve of short-to-long term maturities, and an injection of liquidity into the mortgage market have resulted in record-low Canadian mortgage rates. The average 5-year fixed rate now sits below 2 per cent and is just 165 basis points over the 5-year government bond yield, essentially in line with the long-term average.

While the average 5-year rate has come down considerably, the qualifying rate remains stubbornly high at 4.79 per cent. That rate has become notoriously divorced from its underlying benchmark in recent years and now sits at a spread of close to 450 basis points over the 5-year bond yield, or about 100 basis points higher.

With the Bank of Canada eschewing negative interest rates and providing forward guidance that it has

no plans to raise its policy rate until slack in the economy is absorbed, there is not much on the

horizon that may move mortgage rates one way or the other. We expect a mild rise in rates as the Bank

slows and eventually ends its QE, perhaps by the end of 2021. Studies show QE lowers long-term interest rates by 10-25 basis points, so we can anticipate a similar magnitude rise in 5-year rates when QE ends.

Click here to continue reading.

Click here to visit to BCREA’s website. To view other statistics for the Kamloops and BC real estate market click here.

If you want to be kept informed on Kamloops Real Estate, News and more visit our Facebook Page.

To search for Kamloops real estate and homes for sale click here.

This article appeared on the

This article appeared on the  Canadians are showing a strong ability to manage their debts even as housing prices rise, with arrears on CMHC mortgages at a low 0.34 per cent for the first quarter of this year, according to new figures from the federal housing agency.

Canadians are showing a strong ability to manage their debts even as housing prices rise, with arrears on CMHC mortgages at a low 0.34 per cent for the first quarter of this year, according to new figures from the federal housing agency.