Top 20 Grants and Rebates for Home Buyers and Property Owners

There are ways that property owners and home buyers can save money. On February 25th, 2011 the Vancouver Sun created a list of the Top 25 Grants and Rebates which I have adapted to only include those available in the Kamloops area.

1. HOME BUYERS’ PLAN

Qualifying home buyers can withdraw up to $25,000 (couples can withdraw up to $50,000) from their RRSPs for a down payment. Home buyers who have repaid their RRSP may be eligible to use the program a second time. For more information click here. Enter ‘Home Buyers’ Plan’ in the search box.

2. GST REBATE ON NEW HOMES

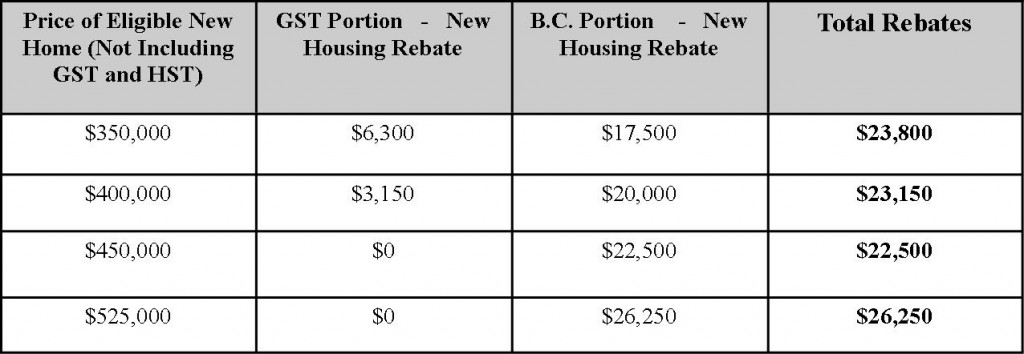

New home buyers can apply for a rebate of the federal portion of the HST (the 5% GST) if the purchase price is less than $350,000. The rebate is up to 36% of the GST to a maximum rebate of $6,300. There is a proportional GST rebate for new homes costing between $350,000 and $450,000. For more information click here. Enter ‘RC4028’ in the search box.

3. BC NEW HOUSING REBATE (HST)

Buyers of new or substantially renovated homes priced up to $525,000 are eligible for a rebate of 71.43% of the provincial portion (7%) of the 12% HST paid to a maximum rebate of $26,250. Homes priced at $525,000+ are eligible for a flat rebate of $26,250. For more information click here.

4. BC NEW RENTAL HOUSING REBATE (HST)

Landlords buying new or substantially renovated homes are eligible for a rebate of 71.43% of the provincial portion of the HST, up to $26,250 per unit. Click here for more info.

5. BC PROPERTY TRANSFER TAX (PTT) FIRST TIME HOME BUYERS’ PROGRAM

Qualifying first-time buyers may be exempt from paying the PTT of 1% on the first $200,000 and 2% on the remainder of the purchase price of a home priced up to $425,000. There is a proportional exemption for homes priced up to $450,000. For more information click here.

6. FIRST-TIME HOME BUYERS’ TAX CREDIT (HBTC)

This federal non-refundable income tax credit is for qualifying buyers of detached, attached, apartment condominiums, mobile homes or shares in a cooperative housing corporation. The calculation: multiply the lowest personal income tax rate for the year (15% in 2010) x $5,000. For the 2010 tax year, the maximum credit is $750. For more information click here.

7. BC HOME OWNER GRANT

Reduces school property taxes by up to $570 on properties with an assessed value up to $1,150,000. For 2011, the basic grant is reduced by $5 for each $1,000 of value over $1,150,000, and eliminated on homes assessed at $1,264,000. An additional grant reduces property tax by a further $275 for a total of $845 for seniors, veterans and the disabled. This is reduced by $5 for each $1,000 of assessed value over $1,150,000 and eliminated on homes assessed at $1,319,000+. For more information click here.

8. BC PROPERTY TAX DEFERMENT PROGRAMS

Property Tax Deferment Program for Seniors. Qualifying home owners aged 55+ may be eligible to defer property taxes. Financial Hardship Property Tax Deferment Program. Qualifying low-income home owners may be eligible to defer property taxes. Property Tax Deferment Program for Families with Children. Qualifying low income home owners who financially support children under age 18 may be eligible to defer property taxes. For more information click here and enter ‘Property tax deferment’ in the search box or contact your municipal tax office.

9. CANADA MORTGAGE AND HOUSING (CMHC) RESIDENTIAL REHABILITATION ASSISTANCE PROGRAM (RRAP) GRANTS.

This federal program provides financial aid to qualifying low-income home owners to repair substandard housing. Eligible repairs include heating, structural, electrical, plumbing and fire safety. Grants are available for seniors, persons with disabilities, owners of rental properties and owners creating secondary and garden suites. For more information click here.

10. CMHC MORTGAGE LOAN INSURANCE PREMIUM REFUND

Provides home buyers with CMHC mortgage insurance, a 10% premium refund and possible extended amortization without surcharge when buyers purchase an energy efficient mortgage or make energy saving renovations. For more information click here.

11. ENERGY SAVING MORTGAGES

Financial institutions offer a range of mortgages to home buyers and owners who make their homes more energy efficient. For example, home owners who have a home energy audit within 90 days of receiving an RBC Energy SaverT Mortgage, may qualify for a rebate of $300 to their RBC account. For more information click here.

12. LOW INTEREST RENOVATION LOANS

Financial institutions offer ‘green’ loans for home owners making energy efficient upgrades. Vancity’s Bright Ideas personal loan offers home owners up to $20,000 at prime + 1% for up to 10 years for ‘green’ renovations. RBC’s Energy Saver loan offers 1% off the interest rate for a fixed rate installment loan over $5,000 or a $100 renovation on a home energy audit on a fixed rate installment loan over $5,000. For information visit your financial institution.

13. LIVESMART BC: EFFICIENCY INCENTIVE PROGRAM

Home owners improving the energy efficiency of their homes may qualify for cash incentives through this provincial program provided in partnership with Terasen Gas, BC Hydro, and FortisBC. Rebates are for energy efficient products which replace gas and oil furnaces, pumps, water heaters, wood stoves, insulation, windows, doors, skylights and more. The LiveSmart BC program also covers $150 of the cost of a home energy assessment, directly to the service provider. For more information click here.

14. BC RESIDENTIAL ENERGY CREDIT

Home owners and residential landlords buying heating fuel receive a BC government point-of-sale rebate on utility bills equal to the provincial component of the HST.

15. BC HYDRO APPLIANCE REBATES

Mail-in rebates of $25 – $50 for purchasers of ENERGY STAR clothes washers, refrigerators, dishwashers, or freezers until March 31, 2011, or when funding for the program is exhausted. For more information click here.

16. BC HYDRO FRIDGE BUY-BACK PROGRAM

This ongoing program rebates BC Hydro customers $30 to turn in spare fridges in working condition. For more information click here.

17. BC HYDRO WINDOWS REBATE PROGRAM

Pay no HST when you buy ENERGY STAR high-performance windows and doors. This offer is available until March 31, 2011.

18. BC HYDRO MAIL-IN REBATES/ SAVINGS COUPONS

To save energy, BC Hydro offers rebates including 10% off an ENERGY STAR cordless phone. Check for new offers and for deadlines. For more information click here.

19. TERASEN GAS REBATE PROGRAM

A range of rebates for home owners include a $50 rebate for upgrading a water heater, $150 rebate on an Ener-Choice fireplace (both good to March 31, 2011) and a $1,000 rebate for switching to natural gas (from oil or propane) and installing an ENERGY STAR heating system (good to Feb. 29, 2012). For more information click here and in the search box enter ‘rebates’.

20. TERASEN GAS EFFICIENT BOILER PROGRAM

For commercial buildings, provides a cash rebate of up to 75% of the purchase price of an energy efficient boiler, for new construction or retrofits. For more information click here and in the search box enter ‘gas efficient boiler program.

Link (Story removed)