What the Analysts say about B.C. Real Estate for 2009

In Kamloops, I continually talk to clients regarding the local real estate market and the factors contributing to the recent downturn. There are many predictions and opinions about the market. Below I have compiled a series of analyst opinions on the BC and national real estate market which in turn directly apply to Kamloops real estate. Hopefully you will find this information useful to your search, whether you are a home buyer, seller or just looking for some clarification.

Scotiabank’s senior economist Adrienne Warren says Canadian real estate prices will drop 10-15% nationally, with B.C., Alberta and Saskatchewan taking the brunt of the downturn. They predict that much of the runup in prices seen this decade will remain intact.

Canadian Association of Accredited Mortgage Professionals (CAAMP) report states that despite the traumatic American mortgage fall out, Canada has managed to steer clear of deflated markets. The Canadian system is supported by low and steady interest rates, better underwriting processes, different products and normal re-sale activity levels. “Canada is a financially conservative country where consumers are able to meet the terms of their mortgages and buying decisions are based on affordability,” said Dunning. “This contributes to a solid real estate market that will not experience the same drop off we see south of the border.”

Cameron Muir of BCREA believes BC could see an upswing in housing markets as early as spring 2009. This doesn’t necessarily mean that housing prices will increase. Consumer confidence in the market is predicted to stabilize and buyers will become more active in the market place.

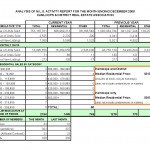

CMHC see a further drop of up to 9% in 2009. Home prices in Kamloops and district have fallen so far anywhere from 10% and above to date.

Ozzie Jurock sees increased activity in Spring and sales lower in 2009 and calls for us to start thinking positively.

Other points of interest:

- Across the country, downward movement of house prices are only 3% year-over-year in the third quarter (compared with a 5 to 15% decline in the U.S.)

- International studies conducted by agencies such as the International Monetary Fund have found that Canada is still considered to be one of the countries where the housing market is least overvalued

- Canada’s housing market is also much less vulnerable given the very limited sub-prime mortgage activity (5% of outstanding mortgages compared to approximately 14% in the U.S.)

- The speculative sector is relatively small

- Housing affordability – which had deteriorated over the past two years – will improve with the recent significant rate cuts by the Bank of Canada and softer house prices.

They all agree that consumer confidence is one of the real estate market’s biggest challenge. There is a lot of uncertainty locally in Kamloops and in the world as a whole. Predictions are never certainties. There are a number of factors that affect consumer confidence and unfortunately this confidence is not only a local and national feeling but also a world wide concern.