Author: Kirsten Mason

Vancouver Real Estate Skews National Home Price Upward for April 2011

This article appeared on CBC News on May 17th, 2011 and was written by Sunny Freeman.

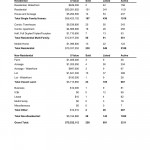

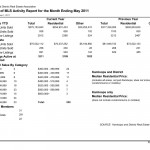

The national average home price rose by eight per cent in April even as housing sales fell by 14.7 per cent from the year before, according to data released Tuesday by the Canadian Real Estate Association.

“Changes to mortgage regulations that took effect in April 2011 likely sidelined a number of first-time homebuyers,” said Gregory Klump, CREA’s chief economist.

Those changes, which actually took effect midway through March, cut the longest possible amortization period to 30 years from 35 years, an effort to curb high-risk borrowing. However, it also forced some potential buyers out of the market who couldn’t afford the higher monthly payments for the shorter period.

The new rules had already left a mark on existing home sales during the previous quarter as home sales surged to their highest level in a year as buyers rushed in to beat the tougher restrictions, said Leslie Preston, an economic analyst at TD Economics.

“We don’t expect the first quarter’s pace to be sustained (through the rest of the year) and April’s reading sets the stage for an expected softening,” she said.

Meanwhile, similar government moves last spring that made it harder to qualify for a mortgage, and that gave sales a boost last April that amplified the year-over-year decline even further.

“Last April, several transitory factors artificially boosted sales. This included the impending tightening of mortgage rules, speculation about higher interest rates and the looming introduction of the HST in some provinces,” said Klump.

He said that additional measures to tighten mortgage rules and other factors made it difficult to compare the latest results to a year earlier and reliably gauge the impact of the mortgage rule changes.

Further adding to pressure on buyers, the national average home prices rose by eight per cent to $372,544 compared to last April — the third consecutive month in which the national average price rose by eight per cent from year ago levels.

A boom in sales of multi-million dollar properties, largely in the Greater Vancouver area, has been skewing the average home price upward in recent months. Average home prices in British Columbia were up 16 per cent, double the national average — sending the country-wide average higher.

“Higher end home sales in Greater Vancouver and Toronto had their best April ever,” Klump said.

In Vancouver, average home prices were $879,039 last month. In Toronto, they were up to $477,407. Excluding Toronto and Vancouver, seasonally-adjusted prices dipped 0.5 per cent to $367,600, said BMO Capital Markets economist Robert Kavcic.

While demand for high-end properties fell in April compared to March, so did sales of lower-priced properties, helping to keep average home prices high.

The number of newly listed homes edged up 1.3 per cent in April from March, but remained well below levels in January and February, when the coming mortgage rule changes were announced.

“New listings are down a hefty 15 per cent year-over-year, one big reason why prices remain lofty despite moderating sales activity. This is especially true in pricier markets like Toronto (-29.9 per cent year-over-year) and Vancouver (-23.4 per cent year-over-year),” Kavcic said.

The total number of homes sold on CREA’s Multiple Listing Service in April fell to 16,525 from 17,937 a year ago. On a seasonally adjusted basis, sales were down 4.4. per cent from March of this year.

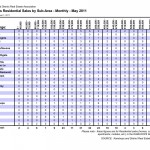

Declines were largest in some of Canada’s most expensive and active markets, including Toronto, Vancouver and British Columbia’s Fraser Valley. Still, sales activity in April was up from last year in a number of local markets, the association said.

Year-over-year comparisons should become less pronounced in the coming months, as last year sales dipped 17 per cent in May and June, Kavcic said.

“Canada’s housing market appears well balanced overall, with the ratio of sales to new listings bang on its long-run average, though some local markets are clearly hotter than others,” he said.

“Higher mortgage rates and now stricter mortgage rules should keep sales and prices well behaved in the year ahead.”

CREA said that the increases in newly-listed homes combined with fewer sales in April helped push more than two-thirds of local markets considered balanced.

The national sales-to-new listings ratio, a measure of market balance, stood at 52.5 per cent in April, down from 55.7 in March.

The number of months it would take to sell all of the listings on the MLS, another measure of supply and demand, was up to six months in April, up from 5.7 months in March.

Housing starts — another key indicator of demand for homes — were slower than expected in April, largely due to a decline in construction on multi-unit buildings such as apartments and condos. That was much weaker than economists had been expecting, as construction activity usually picks up in the spring.

A drop in housing starts and sales of previously occupied homes had been widely anticipated. However, the expected drop in home sales across Canada this year will be less than previously forecast because of stronger sales of mega-homes in British Columbia in the first quarter, the Canadian Real Estate Association said earlier this month.

CREA now expects that unit sales for 2011 will dip 1.3 per cent to 441,100, less than the 1.6 per cent decline it forecast in February.

National sales activity of homes sold on CREA’s Multiple Listing Services should rebound by 2.6 per cent to 452,000 units in 2012, it added. That’s in line with the previous forecast and the 10-year average for annual activity.

The national average home price is forecast to rise four per cent in 2011 to $352,500 and by 0.9 per cent to $355,800 in 2012. If that prediction is to hold true, prices will have to fall nearly six per cent in coming months from the $372,544 average price reported in April.

Bank of Canada Signals “Eventual” Interest Rate Hike

This article appeared on Reuters on May 31st, 2011 and was written by Louise Egan and edited by Chizu Nomiyama.

The central bank now sees underlying inflation as only “relatively subdued” rather than “subdued” as in previous statements, but it did not change its overall outlook for inflation. It repeated that the persistent strength of the Canadian dollar “could create even greater headwinds for the Canadian economy” and dampen inflation.

Temporary supply chain disruptions from Japan will sharply restrain growth in the second quarter but this should be unwound afterward, it said.

It said the U.S. economy continued to grow modestly and European growth was maintaining momentum, but it said risks to peripheral European economies had increased.

The currency rose as high as C$0.9685 to the U.S. dollar, or $1.0325, up from C$0.9723 to the U.S. dollar, or $1.0285, immediately before the announcement. It was the Canadian dollar’s strongest level since May 20.

The central bank became the first in the Group of Seven advanced economies to tighten monetary policy following the global financial crisis, hiking three times from June-September last year but pausing since then due to the weak global recovery.

There has been no consensus among market players on when the bank would resume the tightening cycle but July had recently been ruled out by most as a possibility.

Three of Canada’s largest commercial banks pushed back their rate hike expectations to September from July over the past two weeks.

Thirty-five of 43 forecasters surveyed by Reuters last week predicted the next rate hike would be in the third quarter, implying a move in either July or September, or both.

Overnight index swaps, which trade based on expectations for the key central bank policy rate, showed investors slightly reducing the likelihood of a rate hike in July, but increasing the odds of tightening in September, October and December.

Swaps showed markets see a 94.3 probability the central bank will keep its benchmark rate on hold in July, up from 93.56 percent just before the rate decision.

Featured Property: 5400 Ronde Lane, Barnhartvale, Kamloops, B.C. $304,900

To view all homes for sale in Kamloops click here.