This article was written by Dirk Meissner of the Canadian Press and appeared on CanadianBusiness.com on August 31st, 2011.

VICTORIA – The B.C. economy is in for a period of minor ups and downs for the next 18 months, but last week’s voter rejection of the harmonized sales tax is not enough to plunge the province into economic limbo, say economists and business leaders.

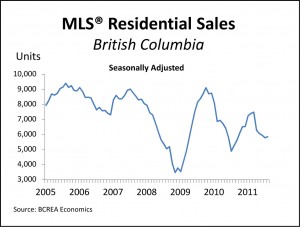

The real estate and housing industries could take a hit as British Columbians wait until March 2013 to save seven per cent on new home purchases or renovations.

But the province’s resource industries could offset those consumer-purchase decisions by ramping up company equipment purchases over the next 18 months, say economists.

Purchases by businesses are eligible for across-the-board tax credits under the HST, but once the PST returns, they will have to pay the seven-per-cent tax in most cases.

“Are you going to stop going to a restaurant until the HST disappears?” asked Simon Fraser University economist John Richards, who suggested that’s unlikely.

But he added: “I suppose there will be some concern about adjusting the timing of the purchase of a house in order to maximize the tax liability.”

Under the HST, homebuyers are charged an extra seven per cent tax on homes priced more than $525,000. Homebuyers are eligible for a tax rebate of up to a maximum of $26,500 under the HST.

Once the PST returns, the seven per cent tax disappears.

Richards, who helped write the independent panel report for the government that examined the impact of the HST, said the HST shifts more taxes to consumers, but it benefits consumers and the economy.

The report, which convinced the Liberals to propose dropping the HST to 10 per cent from 12 per cent, concluded that the move back to the former PST will likely have a negative impact on business and investor confidence because of uncertainty over tax policy.

The panel report concluded the HST would result in a $2.5 billion increase in the B.C. economy by 2020, resulting in 1.1 per cent higher growth.

But Richards said recent criticisms of the government’s 18-month transition timeline by former premier Bill Vander Zalm and Opposition New Democrat Leader Adrian Dix perpetuate the misconceptions about the HST.

Vander Zalm and Dix have said it should take less time to reinstate the PST.

Richards said 18 months is likely reasonable.

“It’s all an indication of the hysteria that was generated around the debate over the last two years that the sky was going to fall because of this new tax,” he said.

Herb Schuetze, a University of Victoria economist, said the transition period back to the PST will likely influence some consumer purchasing decisions, but the impact of those decisions is likely to register only minimally on the economy.

“You might just hold off and that can have some consequences in the short run for the province,” he said.

Schuetze said he doesn’t believe the government is delaying the transition period on purpose, especially with growing speculation of an early provincial election.

“From a political point of view, I don’t think they have much to gain from stretching it out,” he said. “They came out quite quickly to say they were going to re-establish the PST, when my own opinion as an economist would be to re-think the way that people in B.C. are taxed.

“This might be an opportunity to think about, perhaps, changing the provincial sales tax in a way that captures some of the benefits of the HST.”

B.C. Chamber of Commerce president John Winter said he’s been polling his members for direction on the wind-down of the HST because some businesses want the tax to stay as long as possible while others want to fast-track the transition.

Winter said he’s ready to work with the province on the transition, but he’s getting mixed signals from business.

“There’s going to be a major economic impact of this hurry-up” as major businesses purchase equipment to take advantage of the tax credits, he said.

“There’s also going to be a major economic downturn for consumers reluctant to make major purchase decisions knowing that the price will change because of harmonization leaving.”

Winter said he understands that it will take 18 months to re-introduce the PST, but he wants the government to modernize the old tax.

“If they stick to their guns and say nothing is going to happen for 18 months, that may not be very practical,” he said. “Maybe there’s ways to work around that in certain sectors of the economy.”

Richards said there may be a business appetite to change the PST, but politics is playing a larger role in the government’s decision to stick with the old tax as is.

“I would say don’t tamper with it,” he said.

“You immediately raise another hornet’s nest of political opposition. I feel confident in 10 years time, when the dust has settled on this debate, a future government will reconsider and probably reintroduce the HST.”

Link